European Union Customs Union

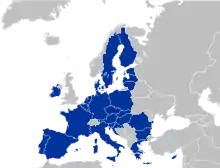

The European Union Customs Union (EUCU) is a customs union which consists of all the member states of the European Union (EU), Monaco, and the British Overseas Territory of Akrotiri and Dhekelia. Some detached territories of EU members do not participate in the customs union, usually as a result of their geographic separation.[lower-alpha 1] In addition to the EUCU, the EU is in customs unions with Andorra, San Marino and Turkey (with the exceptions of certain goods),[lower-alpha 2] through separate bilateral agreements.[2]

European Union Customs Union | |

|---|---|

Non-EU states which participate in the customs union, or are in bilateral customs unions with the EU | |

| Type | Customs union |

| Membership | 27 EU member states

5 states/territories with bilateral agreements

|

| Establishment | 1968[1] |

| Area | |

• Total | 4,950,000 km2 (1,910,000 sq mi) |

| Population | |

• 2021 estimate | |

| GDP (PPP) | 2021 estimate |

• Total | |

| GDP (nominal) | 2021 estimate |

• Total | |

|

|---|

| This article is part of a series on the politics and government of the European Union |

|

|

There are no tariffs or non-tariff barriers to trade between members of the customs union and – unlike a free-trade area – members of the customs union impose a common external tariff on all goods entering the union.[3]

The European Commission negotiates for and on behalf of the Union as a whole in international trade deals (such as that with Canada and many others), rather than each member state negotiating individually. It also represents the Union in the World Trade Organization and any trade disputes mediated through it.

Following the UK's withdrawal from the European Union in 2020, the United Kingdom withdrew from the EU customs union on 1 January 2021.

Non-EU participants

Monaco and the British Overseas Territory of Akrotiri and Dhekelia are integral parts of the EU's customs territory.[2][4]

| State / territory | Agreement | Entry into force |

|---|---|---|

| Franco-Monegasque Customs Convention[5][6][7] | 1968 | |

| Treaty of Accession 2003[8] Brexit withdrawal agreement[4] | 1 May 2004 |

Bilateral customs unions

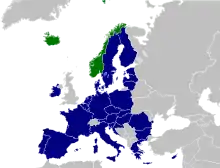

Andorra, San Marino and Turkey are each in a customs union with the EU.[2]

| State | Agreement | Entry into force | Notes |

|---|---|---|---|

| Agreement in the form of an Exchange of Letters between the European Economic Community and the Principality of Andorra – Joint Declarations[9] | 1 January 1991 | Excludes agricultural produce | |

| Agreement on Cooperation and Customs Union between the European Economic Community and the Republic of San Marino[10] | 1 April 2002 | ||

| Decision No 1/95 of the EC-Turkey Association Council of 22 December 1995 on implementing the final phase of the Customs Union[11] | 31 December 1995 | Excludes agricultural produce | |

Special arrangements concerning Northern Ireland

The United Kingdom left the European Union on 31 January 2020 and the withdrawal period ended on 31 December 2020. Northern Ireland is no longer a member of the European Union Customs Union. Trade is now regulated by the EU-UK Trade and Cooperation Agreement and the European Union (Future Relationship) Act 2020. This includes special provisions for trade in goods between Northern Ireland and the EU which for many purposes are similar to those within the Customs Union.

Intended special arrangements concerning Gibraltar

Gibraltar was never part of the Customs Union. A political agreement has been reached between the EU, the UK and Gibraltar to negotiate a new treaty which will include provisions for trade on goods between the EU and Gibraltar.[12] These will be "substantially similar" to those within the Customs Union. The agreement has not been signed.

EU territories with opt-outs

While all EU member states are part of the customs union, not all of their respective territories participate. Territories of member states which have remained outside of the EU (overseas territories of the European Union) generally do not participate in the customs union.[13]

However, some territories within the EU do not participate in the customs union for tax and/or geographical reasons:

- Büsingen am Hochrhein (a German exclave within Switzerland, part of the Switzerland–Liechtenstein customs area)[14][15]

- Heligoland (a small German archipelago in the North Sea with VAT free status)[14][13]

- Livigno (an remote alpine town in Italy with VAT free status)[14][15]

- Ceuta and Melilla (Spanish territories in Africa with VAT free status).[14][15]

Historical opt outs

The following territories were excluded until the end of 2019:

- Campione d'Italia (an exclave of Italy surrounded by Swiss territory)

- the Italian waters of Lake Lugano

Union Customs Code

The Union Customs Code (UCC), intended to modernise customs procedures, entered into force on 1 May 2016.[16] Implementation will take place over a period of time and full implementation is anticipated by 31 December 2020 at the latest.[17] The European Commission has stated that the aims of the UCC are simplicity, service and speed.

Common external tariffs

The EU Customs Union sets the tariff rates for imports to the EU from other countries. These rates are detailed and depend on the specific type of product imported, and can also vary by the time of year.[18] The full WTO Most Favoured Nation tariff rates apply only to those countries that do not have a Free Trade Agreement with the EU, or are not on a WTO recognised exemption scheme such as Everything but Arms (an EU support arrangement for Least Developed Countries).

Union and common transit

Union transit, formerly called "Community transit", is a system generally applicable to the movement of non-Union goods for which customs duties and other charges due on import have not been paid, and of Union goods, which, between their point of departure and point of destination in the EU, have to pass through the territory of a third country.[19]

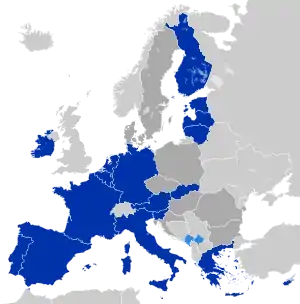

The 'common' transit procedure is used for the movement of goods between the EU Member States, the EFTA countries (Iceland, Norway, Liechtenstein and Switzerland), Turkey (since 1 December 2012), the Republic of North Macedonia (since 1 July 2015) and Serbia (since 1 February 2016). The operation of the common transit procedure with the UK is ensured as the UK has deposited its instrument of accession on 30 January 2019 with the Secretariat of the Council of the EU.[19] The procedure is based on the Convention of 20 May 1987 on a common transit procedure. The rules are effectively identical to those of the Union transit.[19]

Edward Kellett-Bowman MEP, as rapporteur for a European Parliament Committee of Inquiry, presented a report to the Parliament in February 1997 [20] which identified the removal of border controls and a lack of co-operation by member states as being responsible for a rise in organised crime and smuggling.[21] Kellett-Bowman's report led to the European Union setting up a customs investigation body and computerising transit-monitoring systems.[22]

See also

- Community preference

- EU VAT area

- European Customs Information Portal

- European Economic Area (EU and EFTA except Switzerland)

- European Free Trade Association (EFTA)

- European integration

- European Single Market

- European Union–Turkey Customs Union

- Free trade areas in Europe

- Free-trade area

- Market access

- Non-tariff barriers to trade

- Rules of origin

- Tariff

Explanatory footnotes

- For example, the one exclave of Germany within Switzerland.

- See European Union–Turkey Customs Union.

References

- Dinan, Desmond (2014). Europe Recast: A History of European Union (2nd ed.). Basingstoke, New York: Palgrave Macmillan. p. 88. ISBN 978-0-333-69352-0.

- Customs unions, Taxation and Customs Union, European Commission. Retrieved 20 August 2016.

- Erskine, Daniel H (2006). "The United States-EC Dispute Over Customs Matters: Trade Facilitation, Customs Unions, and the Meaning of WTO Obligations". Florida Journal of International Law. 18: 432–485. SSRN 987367.

- Protocol relating to the Sovereign Base Areas of the United Kingdom of Great Britain and Northern Ireland in Cyprus, Agreement on the withdrawal of the United Kingdom of Great Britain and Northern Ireland from the European Union and the European Atomic Energy Community, EUR-Lex, 12 November 2019.

- "Taxation and Customs – FAQ". European Commission. Archived from the original on 8 June 2012. Retrieved 12 September 2012.

- "Council Regulation (EEC) No 2913/92 of 12 October 1992 establishing the Community Customs Code". Official Journal of the European Union. 19 October 1992. Retrieved 12 September 2012.

- "Monaco and the European Union". Gouvernement Princier. Retrieved 31 January 2021.

- Protocol No. 3 on the Sovereign Base Areas of the United Kingdom of Great Britain and Northern Ireland in Cyprus, Act concerning the conditions of accession of the Czech Republic, the Republic of Estonia, the Republic of Cyprus, the Republic of Latvia, the Republic of Lithuania, the Republic of Hungary, the Republic of Malta, the Republic of Poland, the Republic of Slovenia and the Slovak Republic and the adjustments to the Treaties on which the European Union is founded, EUR-Lex, 23 September 2003.

- "Andorra: Customs Unions and preferential arrangements". European Commission. Archived from the original on 26 October 2012. Retrieved 12 September 2012.

- "Agreement on Cooperation and Customs Union between the European Economic Community and the Republic of San Marino".

- "Decision No 1/95 of the EC-Turkey Association Council of 22 December 1995 on implementing the final phase of the Customs Union" (PDF).

- https://english.elpais.com/brexit/2021-01-11/deal-between-spain-and-uk-plans-to-eliminate-gibraltar-border-checkpoint.html

- Territorial status of EU countries and certain territories – European Commission, retrieved 18 December 2018

- Article 6 of Council Directive 2006/112/EC, 28 November 2006

- "REGULATION (EU) No 952/2013 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 9 October 2013 laying down the Union Customs Code, Article 4" (PDF). EURLEX. October 2013. p. 11. Retrieved 17 December 2018.

- "Union Customs Code – Taxation and customs union – European Commission". Taxation and customs union.

- UCC: an Introduction, accessed 29 January 2017

- Taric and Quota Data & Information – European Commission Communication and Information Resource Centre for Administrations, Businesses and Citizens.

- European Union, Union and Common Transit, accessed 24 December 2020

Text was copied from this source, which is available under a Creative Commons Attribution 4.0 International License.

Text was copied from this source, which is available under a Creative Commons Attribution 4.0 International License. - European Parliament, Report on the Community Transit System, 20 February 1997, accessed 31 January 2017

- Neil Buckley, "Cross-border crime loses EU billions: Inquiry blames Brussels and customs for failing to clamp down on smuggling", Financial Times, 21 February 1997, p. 2.

- Neil Buckley, "EU plans single body against smuggling", Financial Times, 13 March 1997, p. 2.

External links

- TARIC database enquiry system, gives current tariff rates applicable by exporting country and season – European Commission: Communication and Information Resource Centre for Administrations, Businesses and Citizens.

- TARIC and Quota Data & Information: user guides for the TARIC database above – European Commission: Communication and Information Resource Centre for Administrations, Businesses and Citizens.

- "Turkey border gridlock hints at pain to come for Brexit Britain". Financial Times, February 16, 2017